Inside My Agency Sale

What I learned selling a small productized agency -- and why I recommend building to sell, whether you're looking for an exit or not.

As soon as I announced that I sold Podcast Ally, the podcast booking agency I founded, the questions started rolling in.

What did you do in the early days that set you up for selling down the road? Where did you find your buyer? What did you learn in the process?

I answered a bunch of these on social media, but I quickly realized that I learned more about building a company through this process than I could possibly cover in a story or thread.

I decided to write it all down in the hopes it might help other agency owners considering a sale.

If you’re curious about how I prepared to sell the agency, what the negotiation process was like, and what I learned along the way, I’m covering all that and more in this post, which is equal parts case study and reflections on the lessons I took in along the way.

Full disclosure before we dive in – I didn’t do my sale the Silicon Valley way, working 100 hours a week and focusing on growth at all costs.

Instead, I built a specialized PR agency that I could run working 20 hours a week, while traveling to national parks and off-grid locations, and without being tied up on Zoom calls all day.

My sales process was equally low-key. I announced that I was open to buyers, resulting in 7-8 interested parties and 4 offers.

Could I have been more aggressive with our growth and gotten more money from the sale?

Almost definitely, but that was never my priority. My intention with Podcast Ally was to build a company that supported my lifestyle and made it easy to bring on and onboard new team members.

By design, the company was easy to run and didn’t generate emergencies for me to deal with.

As a byproduct of my goals in running the company, the business happened to be equally easy to sell, because of the systems and automations I designed to make everything run smoothly.

If there’s anything I learned building Podcast Ally, it’s that putting your energy into operations and team effectiveness is worth it – whether you want to sell or not.

If this sounds appealing to you, I’m going to cover the steps I took in this post.

The only thing I can’t share with you are the terms of the deal. I’m bound by a non-disclosure agreement on that, but otherwise, please ask any questions you have. I’m an open book.

Build A Business That Can Be Sold

Not all businesses can be sold. If you’re a 1-person consultancy with an amazing referral-driven business but nothing’s written down, another owner can’t step in and build on your success.

There’s nothing wrong with earning a great living that way. However, if you want to sell someday, you have to think differently about the way you deliver value to clients.

For Podcast Ally, I made two important decisions up front that made it a lot easier to exit.

First, I organized the company around a productized service model.

This means I standardized everything from the sales process to our service offerings to the way we delivered value to clients.

The benefit of this model is that it makes it easy to manage the entire client experience. Nothing fundamental to the functioning of the company lived only in my brain – it was all documented, automated and scripted.

From the time you signed up for a consultation with me to the end of your year-long project, there was a workflow (often automated) that helped the team create a consistent client experience.

If that sounds like an amazing way to run a business, it is!!

Second, I took care to separate the agency’s branding and reputation from my own.

Podcast Ally wasn’t my first company serving entrepreneurs and thought leaders, so my personal reputation and network were a big part of our success. We couldn’t have built the company as quickly as we did without my past track record in the space.

However, it was important to me that clients knew that I was not the person running their projects when they signed up to work with us. My job as CEO was sales, marketing and supporting the team in doing their best work – not pitching podcasts.

To make this clear up front, I:

Gave the company a name that wasn’t tied to my personal brand

Created separate social media channels for the company

Found opportunities to introduce the team to our audience on social and via our email newsletter

Invited team members to share hosting responsibilities on our podcast

Worked hard to differentiate Podcast Ally from other podcast booking agencies in our marketing and our value proposition

This ended up being a good decision, because when it came time to sell, buyers told me that our brand was a big part of the appeal to them. Podcast Ally is known for our approach to outreach – one focused on long-term relationship-building as opposed to the spray-and-pray spamming so common in the industry.

The business model combined with our brand reputation attracted buyers.

Research What Kinds of Acquisitions are Typical in Your Industry

When I started looking into selling Podcast Ally, I learned that there are two types of deals available to agency owners:

Selling your book of business. This is the model most of us are familiar with, where your business’s value is directly tied to your earnings. The sale price is a multiplier of something called EBITA (earnings before interest, taxes and amortization), which is a measure of company profitability used by most investors. Depending on your industry and your earnings, the multiplier could be 2x - 10x EBITA for an agency.

Selling the intellectual property and assets of the business. A business asset is anything of value your company owns. For some companies, this can include physical goods like computers or equipment, but the definition also covers intellectual property (IP), which is a category of property that includes intangible creations of the human intellectYou can come to an agreement with a buyer on the value (price) of that IP, which is a bit more subjective than the multipliers used for the first type of sale. For example, buyers will consider how much it would cost them to develop their own IP from scratch or simulate it with another tool.

I’m presenting these deals as two distinct types, but there’s a lot of overlap, and buyers will consider the big picture. Your IP is going to be valued more highly when you prove product-market fit. In other words, great IP with little or no revenue proving customer demand is essentially worthless to buyers, but if you have strong recurring revenue, your IP will likely be valued more highly.

In my case, I only had one option – the IP sale. That’s because I decided to close first, then I softly floated selling. This is always why my specific sale is a very unique case study!

I think it’s amazing that 4 buyers made offers, when I disclosed up front that we were closed! That is a testament to the strength of our reputation and the IP I created.

But if I were to give you some unsolicited advice here, I’d say that you probably want to pursue a mix of both sales types to maximize your earnings.

My reasons for doing this backwards are very specific to my personal story, but if you’re interested, I gave a tell-all interview to And She Spoke, a podcast about women, money and power. You can listen to it here.

Inventory Your Assets and IP

Before you can sell your IP, you have to inventory it. With a remote agency like mine, assets and IP are essentially the same thing → the codification of our approach to the work, our contacts and our brand reputation.

If you’ve ever written a sales page, you can think of your IP as the list of all the deliverables + the back-end systems you use to do the work itself (and recruit, hire and train team members).

Here are a few things from my list to give you a more concrete idea of what your IP could look like:

Our complete podcast & pitch database & all associated training materials

The Podcast Ally website, podcast and blog posts

Our recruiting and hiring materials

The sales call guide I use to close clients

Our Podcast Pitch Blueprint library

Creating the IP list did a few important things.

First, it gave me confidence in my product. It’s easy to forget just how much you’ve done when you’re focused on running the business or putting together your next launch.When I started to inventory our IP, I was taken aback when I realized just how much I’d created at Podcast Ally. That felt amazing!

Second, it helped me value the company. I knew that I could sell any one of my assets as a product or through licensing, and that gave me the courage to walk away from some offers that I felt undervalued the company.

And finally, it gave the buyers more confidence in their purchase. I talked to a few companies who told me that our systems were the strongest of any other agency they’d met with, which made the acquisition more attractive.

Taking stock of everything you’ve created is a fun exercise, and it’s a good way to get ahead of your sale. What would you want to be able to include in your own list of “stuff buyers get” when they acquire your company?

Brainstorm Potential Buyers

Once I had a good idea of the type of deal I wanted to do and what would be included, I started to seriously consider who my buyer could be.

From my time working at H+K strategies, I knew that agencies are typically acquired by other agencies who are looking to expand their services and don’t want to start from scratch.

So that’s where I focused my efforts. I figured that our podcast media database, historical data and all those automated workflows I mentioned would be most valuable to someone already serving similar clients with related services.

These types of companies include:

Other PR agencies who don’t yet offer podcast outreach

VA agencies who specialize in marketing

Podcast production agencies

Influencer agencies

Full-service social media or marketing agencies

Competitive podcast booking agencies lacking strong systems and workflows

Before moving on, I want to mention one comment I received when I was sharing some of these insights on Instagram. It went something like, “You were able to sell Podcast Ally, because you served an emerging market."

This was a factor, for sure, but it wasn’t why my agency, specifically, was acquired. There are many competitors in the podcast market now.

Podcast Ally sold, because I did the unglamorous, behind-the-scenes work to create and document workflows that someone else can easily manage. I created a cheat code for another company who wants to create a new line of revenue.

Ultimately, it was our systems and IP, not our early entrance, that made Podcast Ally valuable.

Start Telling People You’re Open to Acquisition!

Once I understood the value I’d created at Podcast Ally and who might benefit from that, all that was left was connecting with buyers.

One very good option is to bring on a business broker, who can help you set a valuation and bring buyers to the table.

I didn’t do that.

I floated the possibility of a sale of Podcast Ally through:

Conversations with other business owners and coaches. This is where I connected with my first potential buyer. It was a referral from my business coach.

My email newsletter. I mentioned I was talking to a potential buyer when I announced the closing of Podcast Ally.

LinkedIn. I posted the same message that I put out in my email newsletter.

A private Facebook business group with 174 members.

Through these posts and updates, I heard from 7-8 different parties that were interested in the company, and of those, I got 4 offers.

I am not comfortable disclosing much about the parties that made offers, as they haven’t consented to that, but there are some lessons here I can draw out for you.

First, all the offers came from people who were already connected to me, or who were one degree of separation away.

In other words, I got those offers because of the network and connections I’d cultivated over my decade+ of working in the online business space.

Second, most of the people who reached out to me were actively looking for a company to buy. This was surprising to me! For example, there was one group who had looked into 20 other companies in the past year. Another person I knew fairly well was also hunting for acquisition opportunities.

I had no idea this was going on!

Third, the folks who weren’t actively pursuing acquisitions fit my customer profile perfectly. In other words, they worked with related customers and were looking for their next move to expand revenue.

Finally, I feel compelled to add that, while I have an amazing network, my list isn’t large.

The email I sent to my list…it went to 2,699 people. This is not exactly an impressive number in online marketing spaces.

So if you’re sitting here thinking, this can’t be me; my reach is too small, please reconsider!

If you do the work to inventory the IP, assets and income potential of your company, you will be able to determine whether you have something attractive to buyers or not. Don’t let the size of your audience hold you back.

If I had done so, I wouldn’t be sitting on my couch writing about my experience right now.

Create a Marketing Doc Sharing the Fundamentals of Your Company

I didn’t put together a marketing document until I had my first conversation with an interested party. Having that conversation first helped me decide what I should include, because it gave me insight into the kinds of questions buyers would have. But if you’re working with a broker, I imagine they’d be able to help you set this up ahead of time.

I cannot stress enough how simple this was to create. After my conversation with the first interested party, I put together a Google Doc that included an overview of our business model, client base and all the IP they’d get with the purchase.

These are the section headers of that doc, which is only 937 words – shorter than this post!

The Business ModelOur Unfair Advantage

Staffing Model

Assets Included in the Sale

Tools & Systems Demo

Looking at the list, we’ve covered most of the information, but you might be wondering about the “Tools & Systems Demo.”

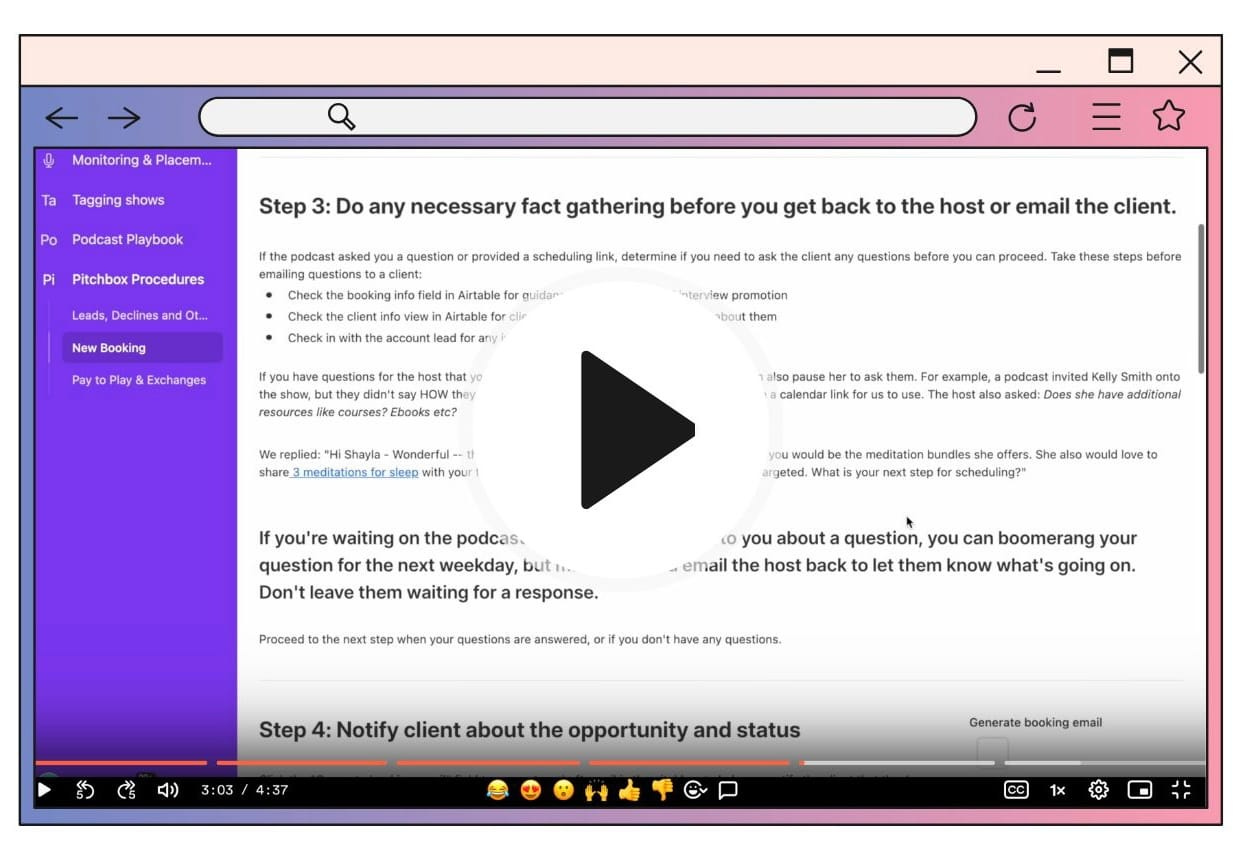

Our biggest asset is the Podcast Relationship Management, or PRM, database I created. This tool is unique in the industry, so I decided to show it off by filming a 4 minute walkthrough using Loom.

I used this marketing document and the video walkthrough as a follow-up piece with prospective buyers. After we had a conversation, where we could gauge mutual fit, I asked them to sign a nondisclosure agreement that included a Non-Use clause that clearly states that the prospects cannot use any of the information I shared beyond determining if they will move forward with acquisition.

Know What Matters to You and Negotiate!

I can’t say much about the negotiations, because all the potential buyers and I signed mutual NDAs. That is pretty standard – and I highly recommend bringing in an attorney when you’re headed to this stage.

What I can say is this: I went into the discussions knowing the value of what I offered, how I’d leverage the IP if I didn’t sell it, and what my non-negotiables were.

Because of this, I walked away from a couple of offers knowing that I might not get the deal I was looking for. Obviously, it worked out, because I’m writing to you from the other side, but at the time, I felt a lot of anxiety.

It helped a lot that I had a few trusted confidantes I could turn to, including a business coach who had worked on acquisitions before, a fellow agency owner who’d been through the process and an attorney who could point out the strengths and drawbacks of the deals presented to me.

But most of all, I knew what mattered to me. I was perfectly fine signing a noncompete clause, because I have no intention of working in PR ever again. Letting go of all that IP didn’t scare me (too much), because I knew I had the skill sets required to create new IP.

More than anything, I wanted to see the company thrive without me. I wanted it to live on, under new ownership that valued integrity, empathy and understood the industry.

If I was going to put the brand I built into a new owner’s hands and turn over all those assets, I wanted to see them build it into something even stronger.

(And yes, I had some personal financial non-negotiables as well.)

When I felt aligned with the new owner – and they felt the same about Podcast Ally – that’s when we closed the deal.

I hope that seeing the experience of someone who sold a relatively small agency with a small list (by online marketing standards) has shown you what’s possible for your own business.

If all we see are flashy examples with unicorn results, then that’s all we believe is possible. I hope my experience helps you see that there are many paths that can lead to an exit, and you don’t need to put in 100-hour weeks, pursue growth at all costs or build a massive list to create one for yourself.

If there’s anything you’d like to know that I haven’t covered, please drop a comment.

If I get enough questions, I’ll update and expand this post, so it’s the best possible resource for other agency owners.

Hope this has helped you.

Thanks for writing this!!

I am currently building an organic growth agency where one of our core offerings is PR as a service (which I learnt from one of your courses :p), and this document has given me so much clarity and vision!

Thanks Brigitte, love from India <3